Manufacturing’s Mood Swings: What August 2025 PMI Tells Us About the Global Economy

If the US manufacturing sector were a person, August 2025 would find them sitting on the couch with a pint of ice cream muttering “It is not me, it is the economy.” The ISM Manufacturing PMI came in at 48.7 percent, marking the sixth consecutive month of contraction.

Translation: factories are still moving but they are not exactly throwing celebrations.

The Numbers Do Not Lie (But They Might Be Sarcastic)

New Orders: 51.4 percent. Finally above water like that roommate who manages to pay rent on time for the first time in half a year.

Production: 47.8 percent. Slipped back into contraction. It is like signing up for the gym and then skipping every class after the first week.

Employment: 43.8 percent. Factories clearly said “We will call you if we need you” to a lot of workers.

Prices: 63.7 percent. Materials are still expensive. It is as if steel and copper decided they too deserve luxury vacations.

So yes the sector is wobbling but the overall U S economy is still expanding thanks largely to services. In other words manufacturing is sulking but the party continues.

Geopolitical Spice

Metals like copper and aluminum are fluctuating more than a teenager’s mood. Add in tensions in the South China Sea and you get supply chains playing a reality show version of Survivor.

Energy is still flexing. Petroleum and coal products are expanding because apparently fossil fuels did not receive the retirement letter. This leaves investors torn between “save the planet” and “save my portfolio”. Spoiler: most choose the portfolio.

Sector Hotspots: Who is Hot and Who is Not

Hot: Apparel and Textiles. Clothes are growing fast. Maybe AI finally designed a shirt that does not shrink after one wash.

Hot: Food and Beverages. People still want snacks no matter what. Try telling someone they cannot afford coffee and you will start a riot.

Warm: Primary Metals. Infrastructure projects are pumping life into steel.

Not Hot: Employment in manufacturing. Factories are ghosting workers like a bad dating experience.

Risk Scenarios: Choose Your Flavor of Trouble

War in the South China Sea. Imagine every electronics store flashing “Out of Stock” before you can say semiconductors.

Energy Shock. Oil prices shoot up and suddenly electric scooters look cooler than sports cars.

Pandemic Two Point Zero. Supply chains promise they learned their lesson but we all know what happened last time. Toilet paper still haunts us.

Climate Catastrophe. Crops fail metals spike and billionaires build bunkers with heated pools.

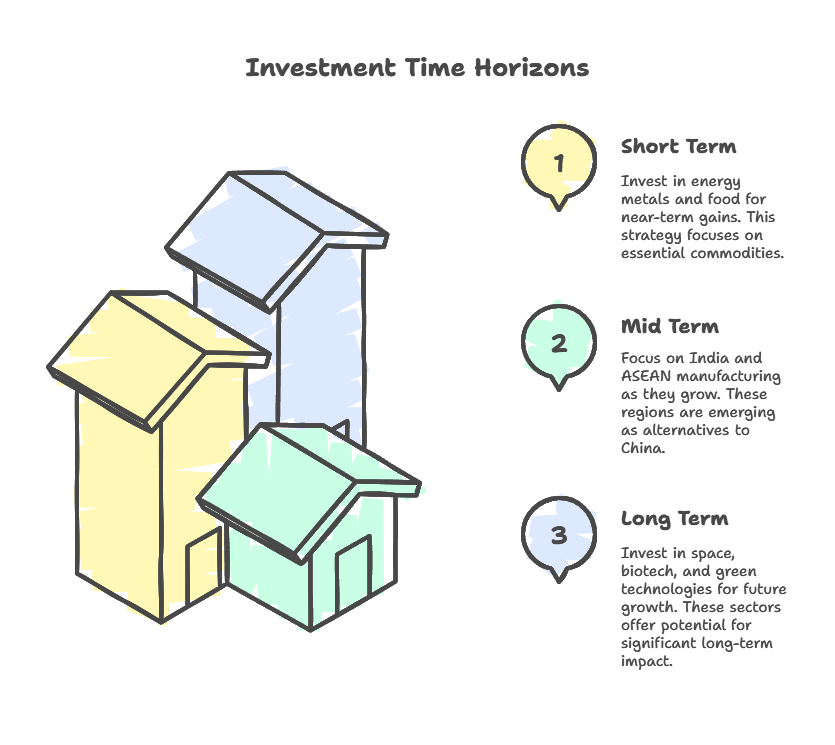

Portfolio Moves: Think in Decades Not Days

Short Term (0 to 3 years). Bet on energy metals and food. It is like investing in the economic version of coffee beer and duct tape.

Mid Term (5 to 10 years). India and ASEAN manufacturing hubs are gaining strength. The world has decided maybe China should not produce everything.

Long Term (20 to 50 years). Space biotech and green technology. If you are investing for your grandchildren they will either thank you for saving humanity or curse you for buying up water rights.

The Punchline

The August PMI does not scream “recession” but it does whisper “stay alert.” Prices are sticky jobs are shaky and supply chains still play Jenga with geopolitics. Yet opportunities are everywhere from energy to food and from rare earth metals to space.

The ultimate play is not just chasing profits. It is building legitimacy with climate investments cultural patronage and philanthropic projects. That way when your wealth grows into trillions people will call you a visionary instead of the guy who bought all the copper.